Are you tired of managing various payments and struggling to keep track of your finances? Do you often wish there was an easier way to control costs and save more money? Keeping track of expenses and bills can be difficult and time-consuming, especially when they range from basic utilities like water to varied subscriptions like Netflix. Have no fear; the solution is here! By leveraging the power of money management apps, you can easily consolidate your bills and save more money without breaking a sweat.

Benefits of using money management apps

Knowing how much you have in the bank is integral for optimal money management and savings, as, let’s face it, there’s no way to pull the plug on expenditure completely. However, knowing how much you are spending and on what can be an eye-opener. Some of the benefits of money management tools are listed below:

- Automatic Bill Payments and Reminders: Money management apps provide automated bill payment options that assist you in avoiding late penalties and maintaining a good credit score. Additionally, you may set up reminders for upcoming payments, ensuring you never miss a due date.

- Goal Tracking and Savings Features: These apps enable you to create objectives and track your advancement, whether saving for a trip, a down payment on a home, or retirement. These programs can transfer money automatically into investment portfolios or savings accounts, assisting you in reaching your financial goals more quickly.

- Real-Time Alerts: You get immediate alerts when there are changes to your account balance, suspicious transactions, or upcoming bill payments. Real-time alerts enable proactive money management by helping you spot possible problems early and stop fraud.

- Financial Collaboration: Some money management apps allow you to share financial data and collaborate with family members or partners. This feature facilitates joint budgeting, expense tracking, and transparent communication, fostering better financial harmony.

- Security and Privacy: Protecting your financial data is a top priority for reputable money management apps. They use cutting-edge encryption methods and secure servers to protect your information, providing peace of mind while handling your finances online.

So, are you ready to start the journey towards better-managed finances, expense tracking, and synchronized budgets? Listed below are the features and functionality of some powerful but user-friendly money management apps. Saving money was never this easy!

Mint

Mint is perfect for independent contractors and small business owners. This app simplifies financial management by automatically categorizing transactions and providing convenient features to capture and import receipts and track business mileage, all within a single platform.

Features:

- Effortlessly export your compiled information directly to popular tax filing services.

- Provides personalized insights to help you make smarter spending decisions.

- It employs multi-factor authentication and multiple hardware and software encryption layers to protect input data.

- Seamlessly integrate your banking activity by logging in with your bank credentials.

Both iOS and Android users can download the Mint app.

-

Available for:

-

Android

-

iOS

PocketGuard

Powered by simple and effective features, PocketGuard is a robust and comprehensive budgeting app that lets you easily view essential numbers such as your available funds, total bills, and remaining balance. It gives you a quick snapshot of your financial status on the go without having to go deep into the analytics.

Features:

- Provides a customizable pie chart that visually represents your expenses.

- It conveniently allows you to set spending limits directly within the app.

- It helps you negotiate better rates for recurring bills, such as cable or cellphone services.

Pocketguard is available for download from the Google Play Store and Apple App Store.

-

Available for:

-

Android

-

iOS

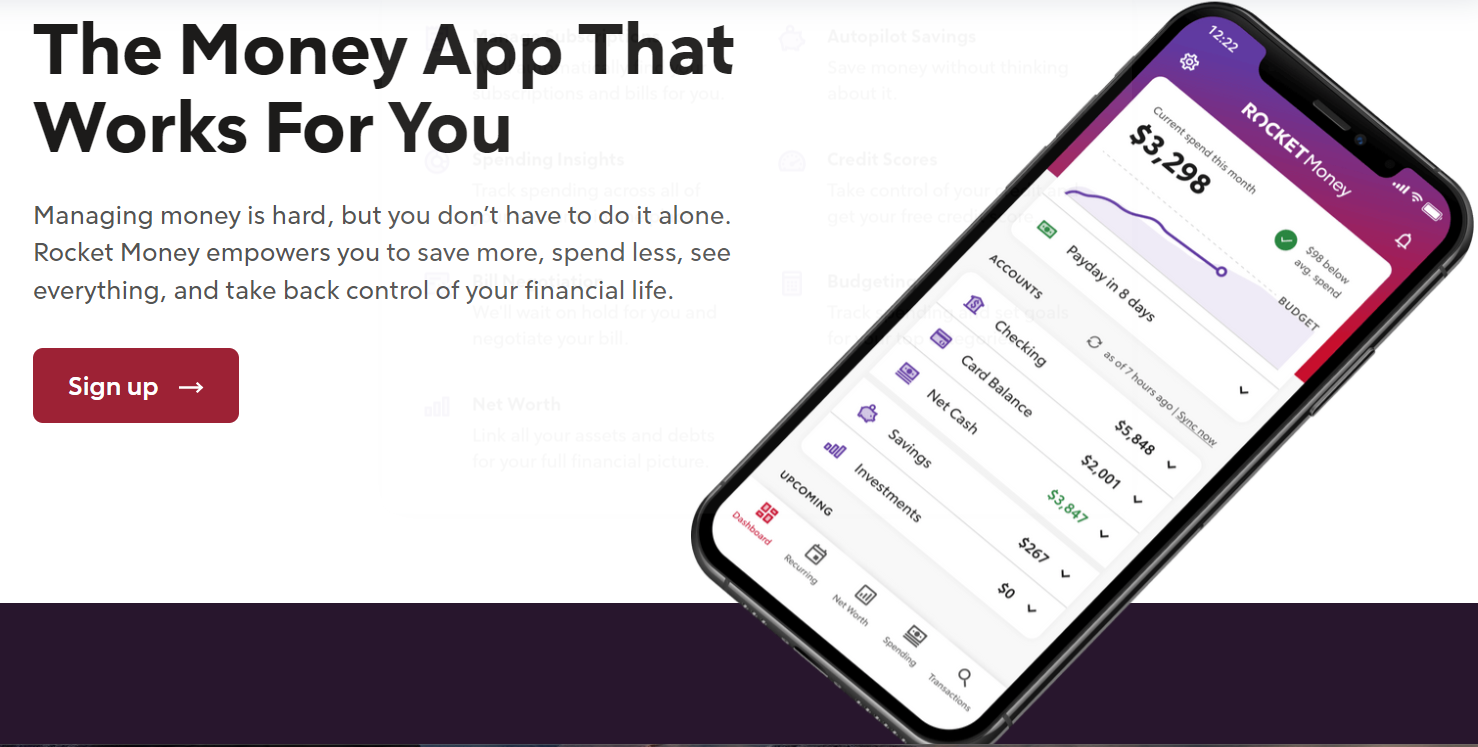

Rocket Money

Rocket Money has a comprehensive range of features that empowers individuals to take control of their finances, reduce expenses, and effectively manage their money.

The app’s rich feature set includes smart savings, credit report monitoring, and net worth tracking, enabling users to gain valuable insights and enhance their financial well-being. Rocket Money offers a free and premium version, employing a unique “pay what you think is fair” model, allowing users to determine the price that aligns with their financial circumstances.

Features:

- It helps you create a personalized financial plan

- Automate savings deposits tailored to your spending patterns

- It assists in real-time tracking of your overall financial worth

- Continuously monitor your credit score and credit report

All this certainly makes Rocket Money a user-friendly personal finance application for Android and iOS devices.

-

Available for:

-

Android

-

iOS

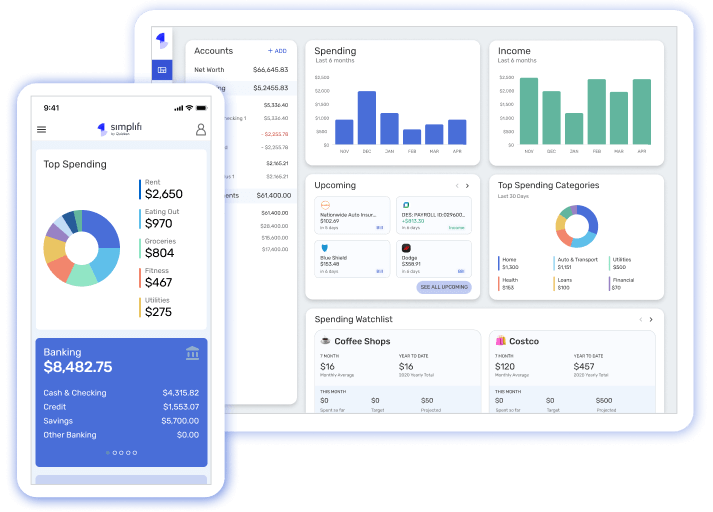

Simplifi

Simplifi by Quicken is an exceptional personal finance management application that presents a holistic and user-friendly approach to financial matters. It enables you to monitor your daily expenses and work towards achieving your savings targets.

Unlike other apps that bombard you with intrusive third-party advertisements and persistent reminders, Simplifi by Quicken ensures an ad-free and customizable experience catering to your requirements at the same time. With this app, you can establish your goals and receive personalized assistance to stay on the right financial track.

Features:

- Enables you to effortlessly access an integrated overview of all your accounts

- Creates customized budgets by considering your income, expenses, and savings.

- It provides convenient alerts, comprehensive reports, and accurate cash-flow projections

- Employs top-tier measures to safeguard your data and privacy, ensuring robust protection.

Simplifi is easily accessible from iOS and Android devices.

-

Available for:

-

Android

-

iOS

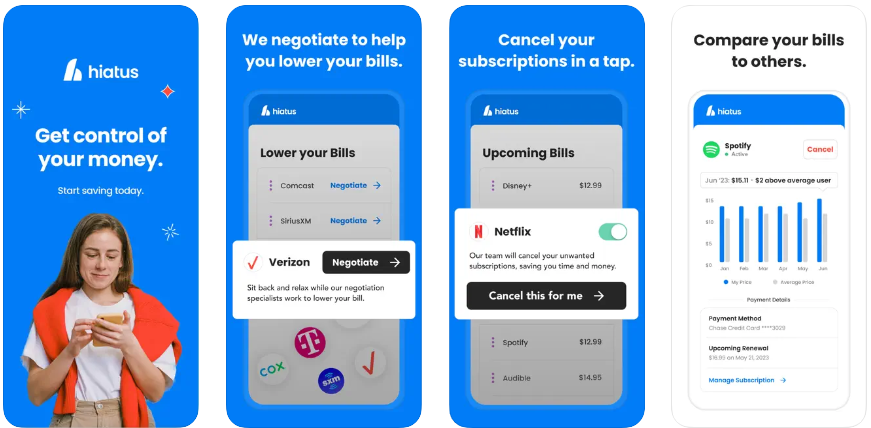

Hiatus

Hiatus is an innovative subscription manager and bill tracker app that empowers you to optimize your finances. With a comprehensive range of budgeting tools, this automated financial assistant is built to enhance your financial well-being.

Hiatus employs advanced technology to help you make advanced spending decisions, establish monthly budgets, and inform you about rate increases. The focus is on giving you better control over your money so that you can accomplish your financial objectives with Hiatus.

Features:

- Keep track of upcoming renewals like subscriptions, memberships, and contracts.

- Prevent overdraft fees by staying aware of your account’s available funds.

- Sends alerts before companies charge you for your bills.

- Budgeting tools to manage your budget on the go.

- Mobile apps for Android and iOS platforms.

Haitus is also available on iOS and Android.

-

Available for:

-

Android

-

iOS

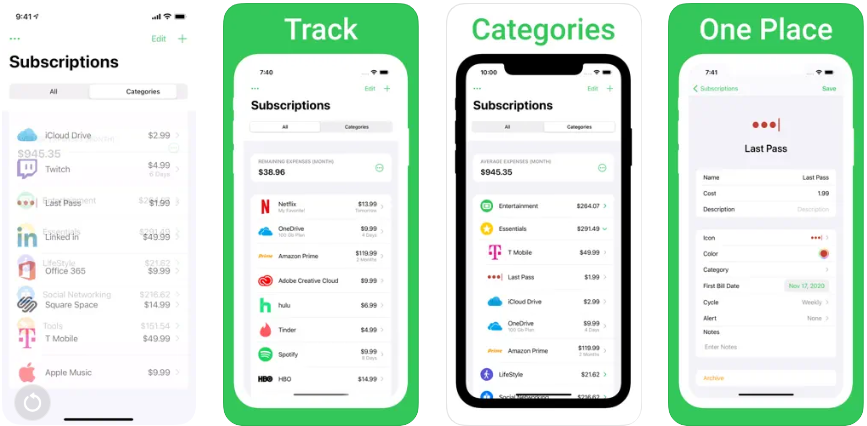

Kango Studios

Imagine a budgeting app that frees you from the tedious task of logging every single transaction. With Kango Studios, you need not pore over receipts, categorize expenses, or feel overwhelmed by the details. The interface and vibrant design will make keeping track of your subscriptions a walk in the park.

Features:

- It enables you to generate multiple portfolio lists for monitoring your preferred stocks.

- It aims to address real-world challenges by developing user-friendly and intuitive mobile applications.

- User-friendly and designed to assist you in achieving your financial objectives.

- Get alerts and notifications (Opt-in only) when subscription bills are due.

Kango is available as an app for Apple devices.

-

Available for:

-

iOS

Bobby

Bobby is a helpful app that assists you in regaining control of your budget by effortlessly monitoring your recurring subscription expenses. With this money management app, you no longer need to spend hours scrutinizing your bank statements. It allows you to easily track and manage multiple subscriptions, providing a clear overview of your monthly spending.

Features:

- It comes with pre-designed subscription graphics for popular platforms such as Netflix, Slack, Spotify, etc.

- Includes reminders to ensure that you are always mindful of the upcoming dates for your automatic payments.

- Assists you in managing your personalized subscriptions, such as rent, gym memberships, and other recurring payments.

Bobby is available as an iOS app.

-

Available for:

-

iOS

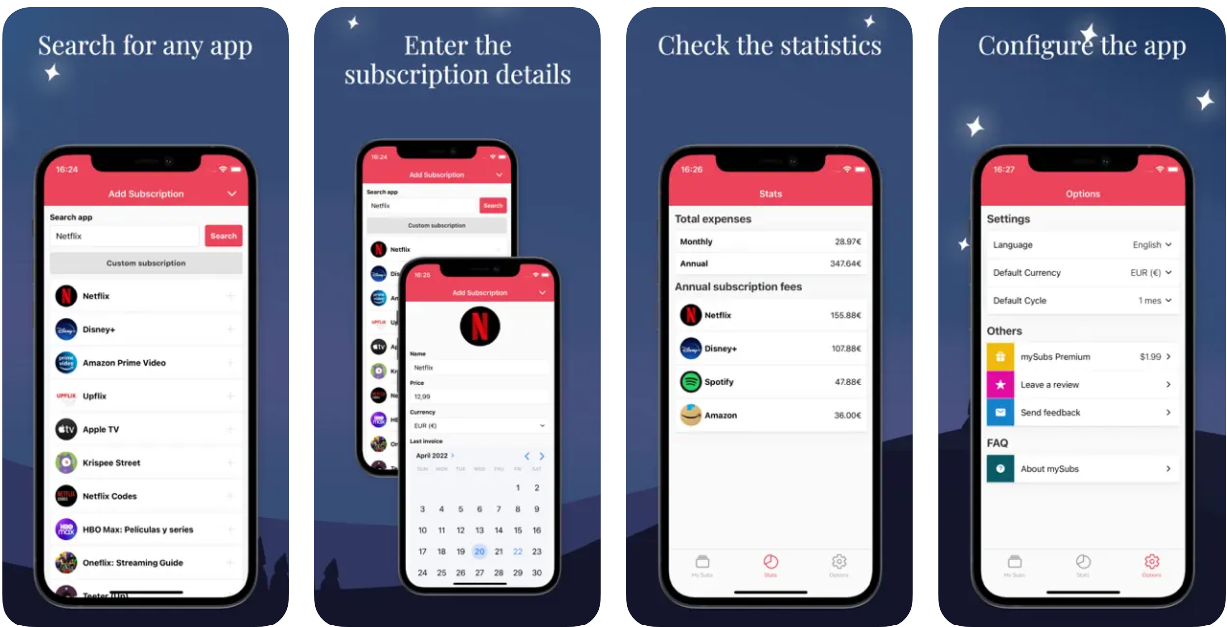

mySubs

mySubs is the ultimate solution to achieve effortless subscription management, empowering you to reclaim your hard-earned money. With this app, you can stay on top of your payment schedules, receive timely reminders, efficiently categorize and separate business expenses from personal ones, and seamlessly update credit card details for hassle-free transactions.

Experience the convenience of tracking your iPhone, iPad, and iPod subscriptions with MySubs!

Features:

- It lets you personalize your subscriptions with handy notes, ensuring you always remember the reasons behind each subscription.

- It gives a comprehensive breakdown of your expenses through detailed reports.

- Provides you with insights into your recurring expenses.

- Convert the currencies of your subscription and recurring expenses.

mySubs is supported on iOS devices.

-

Available for:

-

iOS

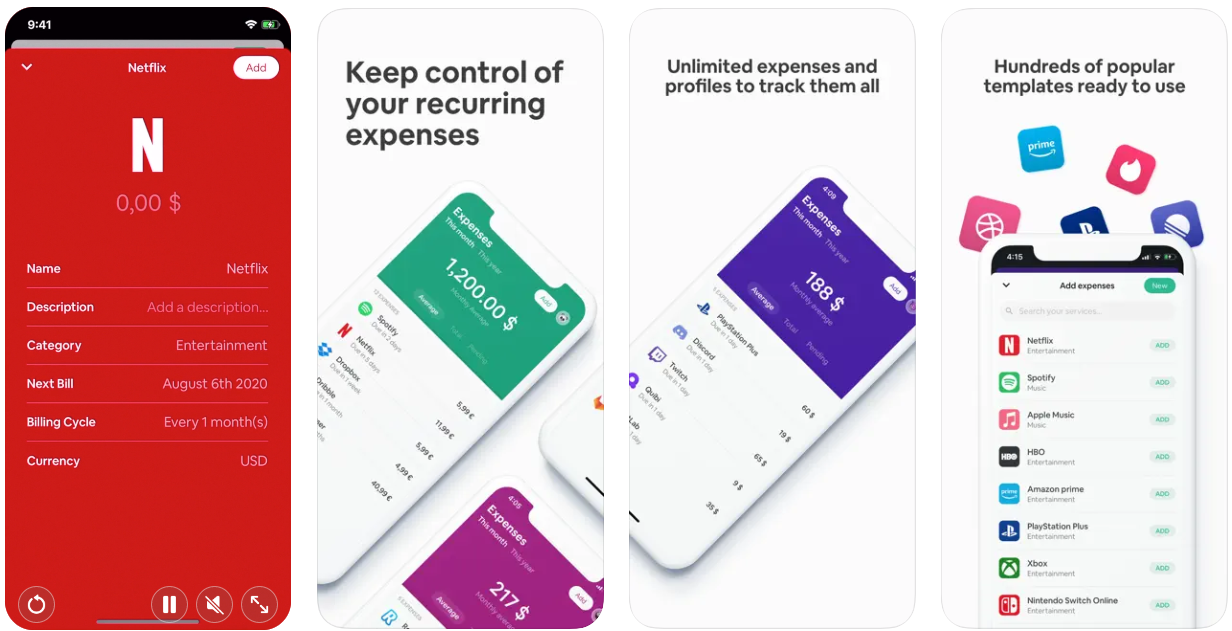

Billbot

Billbot is the ultimate companion for managing your recurring expenses and subscriptions. With Billbot, you can create individual expense profiles, consolidate subscription currencies, gain valuable insights into your fixed costs, and receive timely notifications for upcoming payments.

Whether it’s your rent, utility bills, or streaming services, you can easily organize and manage them all within Billbot’s intuitive interface.

Features:

- It sends notifications from the subscription manager before the expiration of your subscriptions.

- Enables you to incorporate personalized subscriptions or routine expenses using emojis and colors.

- Gives an overview of your expenses, ensuring clarity in your financial management.

Both iOS and Android devices support the Billbot app.

-

Available for:

-

Android

-

iOS

Trim

Trim is a free service designed to assist you in saving money by efficiently managing your subscriptions and earning cash back. By employing an algorithm, Trim can identify recurring charges and engage with users through text or Facebook Messenger for communication.

To recognize recurring charges, Trim necessitates access to your bank accounts. However, to ensure the security of your data, Trim utilizes Plaid, an encryption service. Plaid ensures that Trim does not have access to your login details and only possesses read-only access to your accounts.

Features:

- Offers special deals that allow you to earn cash back on your purchases.

- Sends text alerts to keep you informed about your spending habits.

- Provides guidance and suggestions on how to lower your bills by recommending cost-saving measures.

Trim needs new users to sign-up, which is free.

So, What’s it Going to Be?

Choosing a money management app might seem secondary to other personal financial considerations. Selecting the correct app can significantly impact how well you manage your money. And that is the game changer. You can earn, invest, reap the rewards, etc., but how you spend can ultimately affect all your financial considerations.

The first step to choosing the right money management app or budgeting software is to assess your needs and goals. That will assist in zeroing down on an app that provides insightful information and facts on your costs and savings. By prioritizing and identifying your financial goals, you can limit your search for the best budgeting tool that meets your needs.

However, if you still want to try your hand at old-school, here are some free Excel templates for budgeting that can come in handy. However, if you don’t want to enter data yourself, then an app it is!