A business budget template is a professionally designed format to help businesses document, track and manage their financials. It provides a structured layout for businesses to document income, expenses, and budget allocations.

It is an available tool to create and achieve financial goals. In today’s article, we will discuss why a business budget is a valuable tool for businesses and some of the best templates available in the market.

Importance of Budgeting for Business

Budgeting is crucial for businesses of all sizes for financial management and success. It allows companies to set their financial goals and plan for the future by providing data. It helps businesses to allocate their resources efficiently, such as funds, personnel, and equipment.

Overall, It is a fundamental tool for financial control, future planning, and decision-making in business.

Other benefits of budgeting for business are Expense control, Performance evaluation, data-driven decisions, cash flow management, risk management, communication and accountability, and stakeholder confidence.

Benefits of using Business budget templates

Using business budget templates has several benefits; let’s look at some of these:

- The template is a pre-designed professional framework that saves several hours to create the budget from scratch. The templates have pre-made formulas to simplify calculations, reducing manual work and thus saving time.

- Templates provide a structured way to organize and categorize income and expenses.

- It makes tracking expenses convenient and managing finances efficient. A business can ensure that all income is accounted for and no expenses go overlooked through templates.

- It helps businesses make informed financial decisions by providing relevant and accurate data.

- The templates are the best way to ensure accuracy and consistency in financial calculations using built-in formulas and functions that automatically perform all the calculations. Using templates reduces the risk of errors that can happen during manual calculations.

- A business budget template gives an overview of your business’s financial situation. It helps you to analyze finances and profitability, identify areas of overspending, track variances, etc.

- It also helps your business to set financial goals and plan for the future by projecting income and expenses. You can easily set realistic goals, forecast and create budgets for upcoming projects.

- The templates allow real-time collaboration with team members and simplify communications by providing a centralized platform to input and update financial data.

- The templates are customizable, which allows you to tailor them to your business needs and requirements.

- Using business budget templates makes tracking and documenting financial data easy and convenient.

Smartsheet

Smartsheet is the most helpful tool designed for small businesses offering dynamic work solutions to manage projects, automate workflows, and build solutions at scale. It provides user-friendly business budget templates and empowers to quickly create comprehensive budgets, monitor expenses, and forecast revenue.

The following are the types of templates provided by Smartsheet:

- 12-Month Business Budget Template

- Business Budget Template for Multiple Projects

- Annual Business Budget Template

- Business Expense Budget Template

- Professional Business Budget Template

- Startup Budget Template

These templates provide solutions like expense categorization, automated calculations, customizable visualizations, etc., to manage your business finances and make informed decisions. These easy-to-fill templates are available to download in XLSX format.

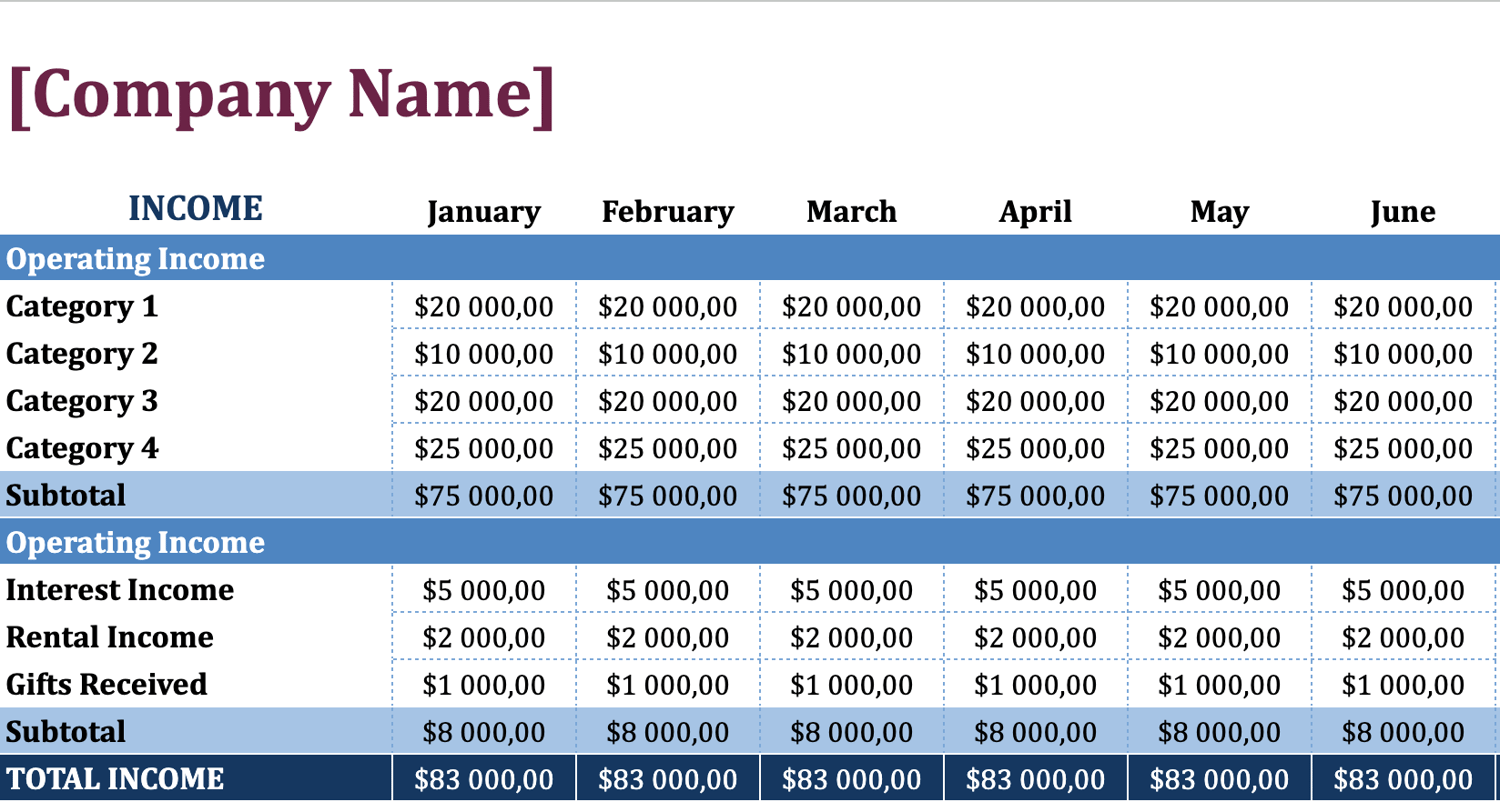

Template Lab

Template Lap provides 37 different business budget templates for businesses to manage financial planning and financial needs. The templates are user-friendly, customizable, and available to download as Excel or Google Sheets.

The templates by Template Lab provide the following information:

- Expected revenue and sales

- Fixed costs

- Variable costs

- Semi-variable costs

- Profits

Types of business templates provided by Template Lab are:

- 12-Month Business Budget Template

- Department Business Budget Template

- Professional Business Budget Template

- Small Business Budget Template

The platform’s templates are best for analyzing profit and loss or collaborating with team members, and most importantly, it helps you stay organized and make informed decisions.

Good Docs

Good Docs are your go-to platform for finding handy forms, business card designs, flyers, brochures, and budget templates. The templates are available in Google Docs, Google Sheets, and Google Slides.

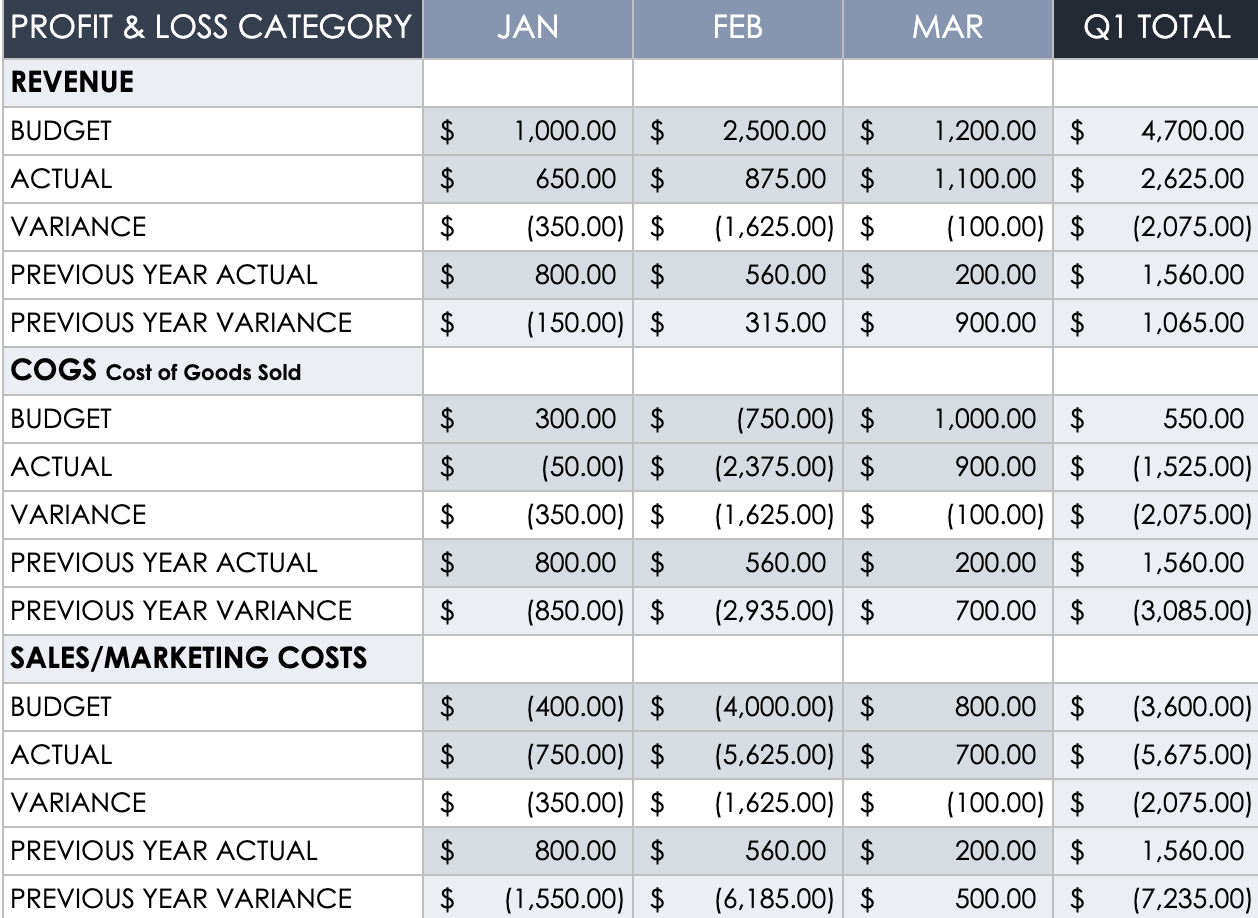

Business budget templates provided by Good Docs are:

- Quarterly Corporate Budgeting

- Financial Budget

- Business Budget

- Cyan Business Budget

- Campaign Budget

- Production Budget

- Small Business Budgeting

The templates are fully customizable to help businesses simplify the budgeting process. It allows for easy tracking of income and expenses and allocates funds to various categories. It provides features to generate insightful reports and accurately calculate totals and variances.

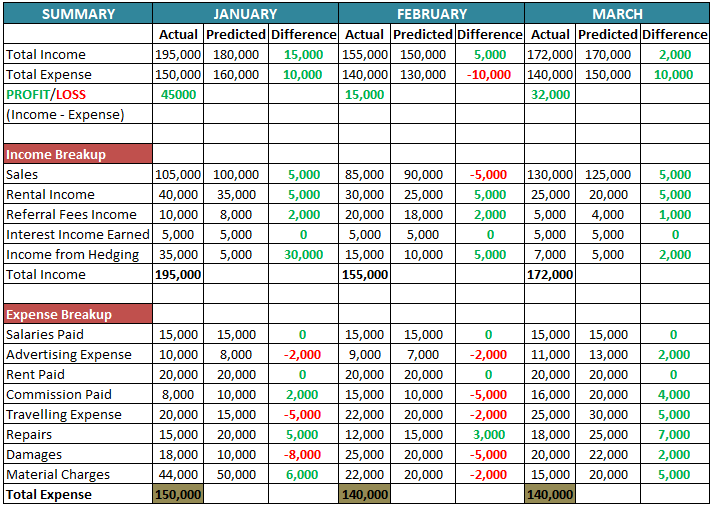

Wall Street Mojo

Wall Street Mojo is a powerful tool for small businesses to meet their demanding financial needs. It provides business budget templates professionally designed to effectively track income, expenses, and budget allocations.

The template provided by Wall Street Mojo has the following contents:

- Profit/Loss calculation

- Income Breakup (Sales, Rental Income, Referral Fees, Interest Income Earned, Income from Hedging)

- Expense Breakup (Salaries Paid, Advertising Expense, Rent Paid, Commission Paid, Traveling Expenses, Repairs, Damages, Material Charges)

The template best provides businesses with financial clarity, offering features like built-in formulas and functions to calculate accurately, customizable charts, and graphs for visualizing financial data. It helps companies to identify trends and make data-driven decisions. The template is available to download as Excel or Google Sheets.

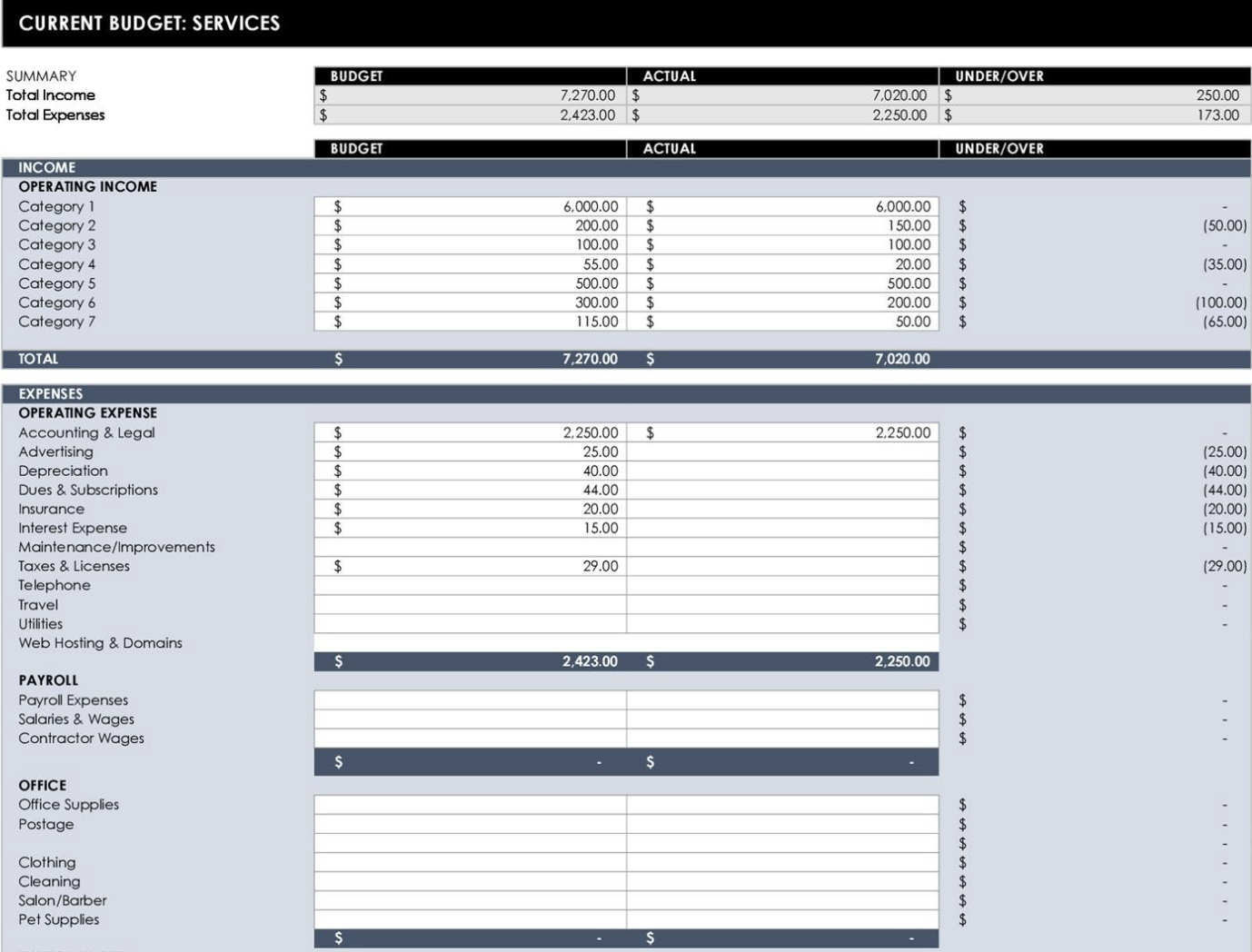

Spreadsheet.com

Spreadsheet.com is a flexible, reliable, and versatile tool helping businesses to build robust project management solutions and custom no-code apps. It provides an easy-to-use spreadsheet template format for business budgets. It helps track income, expenses, and budget allocation easily.

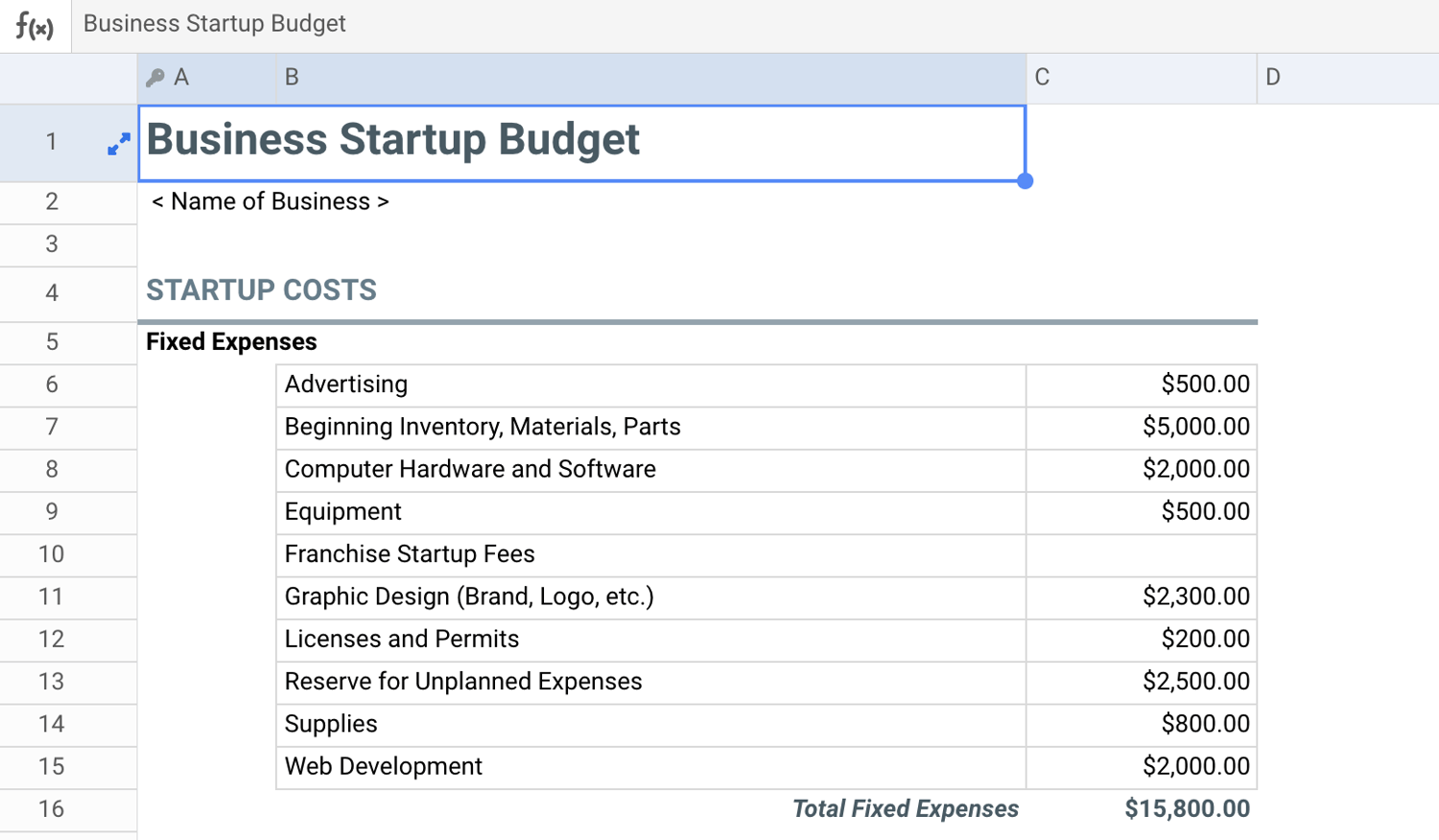

Following is the content of the business startup budget template by Spreadsheet:

- Fixed Expenses

- Average Monthly Expenses

- Startup Funding (Investor Funding, Financing, Other Funding)

The templates are flexible and customizable, enabling you to tailor them to your business needs. The spreadsheet.com business budget helps businesses to perform calculations, generate reports, and gain insights into their financial performance.

Airtable

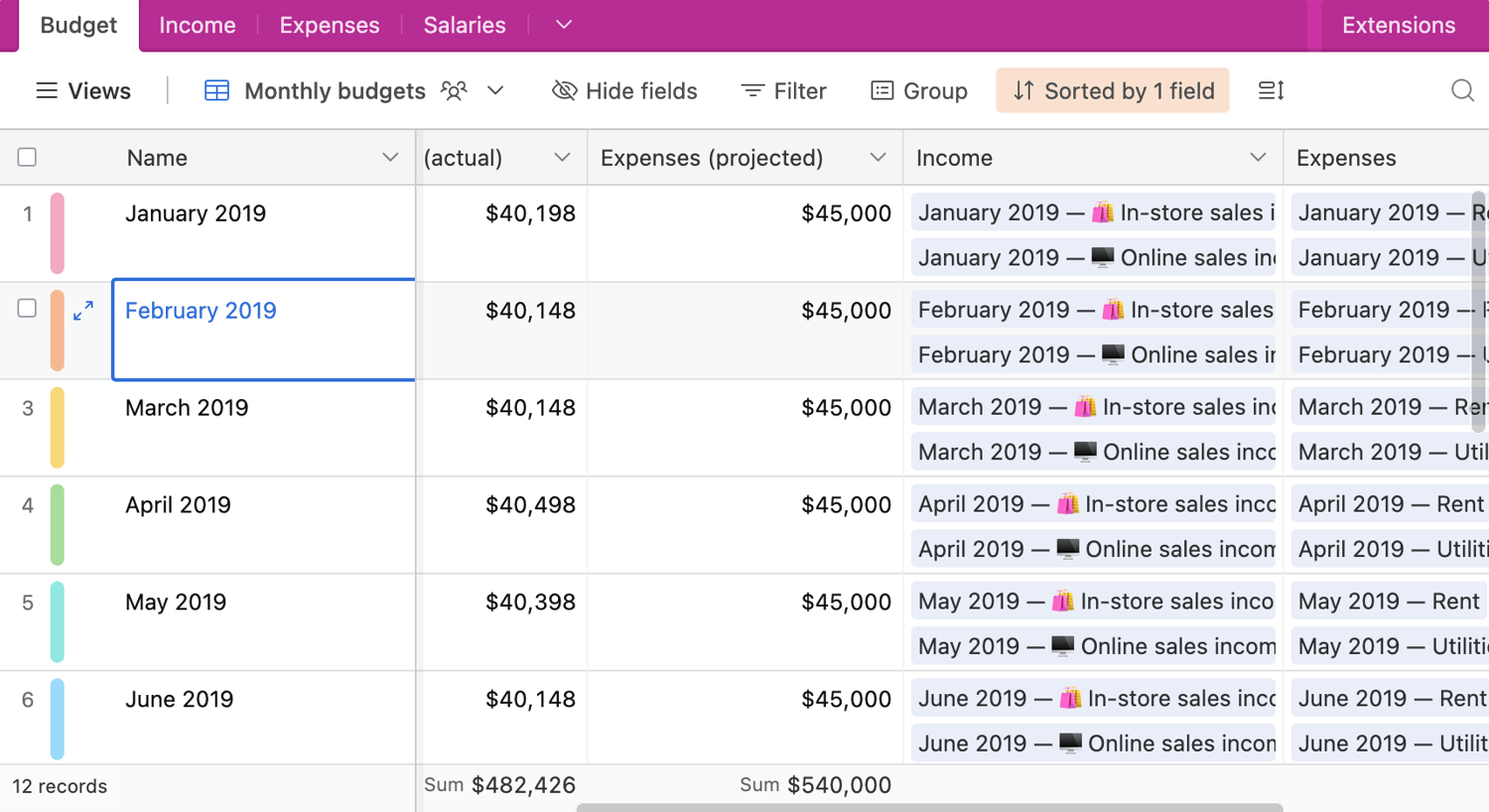

Airtable is a cloud-based collaboration platform helping businesses organize and track data in a customizable and flexible manner. It provides a monthly small business budget template with the following four tabs:

- Budget: It helps you calculate end-of-month balance, actual income, projected income, actual expenses, projected expenses, income, and expenses.

- Income: It shows income earned per month and the type of income.

- Expenses: It helps to identify and track monthly costs and expenses.

- Salaries: It lists employees and their wages.

Airtable template provides up-to-date financial data, allows real-time team collaboration, and ensures seamless teamwork. It can also help to create linked records, perform calculations, and generate visual reports to gain deeper insights into financial performance.

Jotform

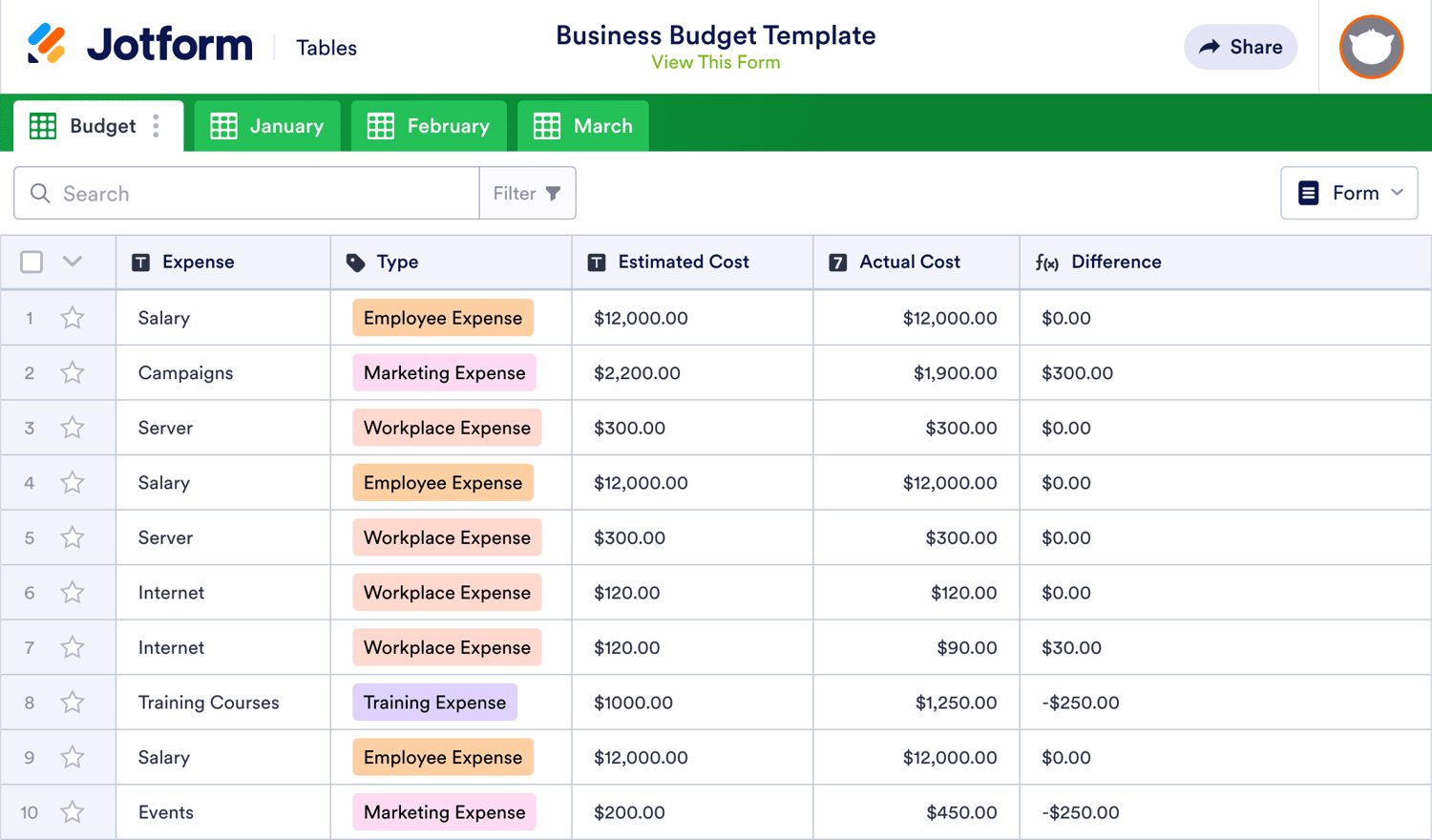

Jotform provides a business budget template to track and manage your business finances easily. The template helps to reduce manual work and automate calculating monthly income and expenses.

You can turn your workload from busy work to minimal effort with robust forms that leverage conditional logic, facilitate payment acceptance, and streamline workflows through automation. It is available to download in CSV, PDF, or Excel file format.

It is an easy-to-use template that allows you to enter data through an attached form or directly into the table. With JotForm’s advanced features, such as calculations and conditional logic, you can automate calculations and dynamically adjust budget items based on specific conditions.

The drag-and-drop interface offers great convenience, and the user-friendly tools make it incredibly easy to navigate. It takes just a few minutes to grasp the concept of their form builder and successfully create our own form.

The Jotform template helps businesses to become organized, streamline budgeting processes and stay on top of their financial health. It comes with a free version and some paid plans; the free version can significantly help small businesses operating on a limited budget.

Notion

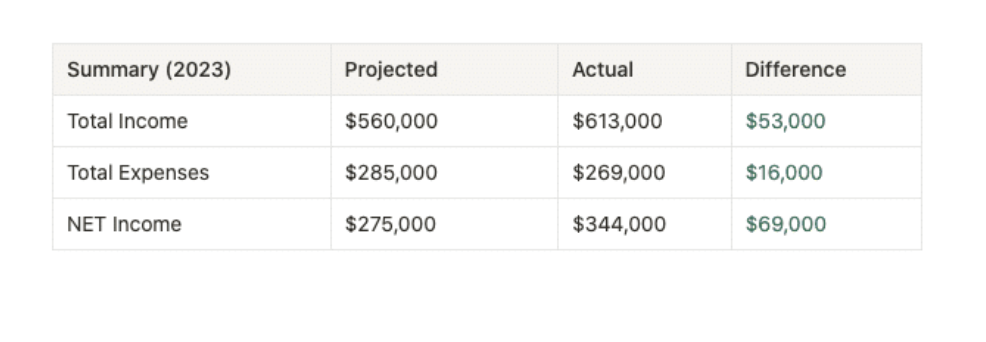

Notion provides a customizable and comprehensive business budget template to manage finances. This template is a valuable tool for making strategic business decisions and gaining visibility into overspendings and areas needing cutbacks.

You have the option to input income and expense information for every month of the year and subsequently generate a comprehensive summary table that reflects the results for the entire year.

Notion’s collaboration features provide transparency and accountability, enabling team members to input and update financial data in real-time.

Before purchasing the template, you need the following:

- Familiarity with Notions and how it works.

- Free account if you need a simple business budget template.

- Paid Notion account if you have to add lots of content.

After creating a Notion account, you can easily download it in Gumroad and access it by clicking “duplicate” on the top right corner of the screen. The instructions for getting started are clear and easy to follow. Additionally, the tool includes pre-existing examples to make it more intuitive when you begin using it.

Workfeed

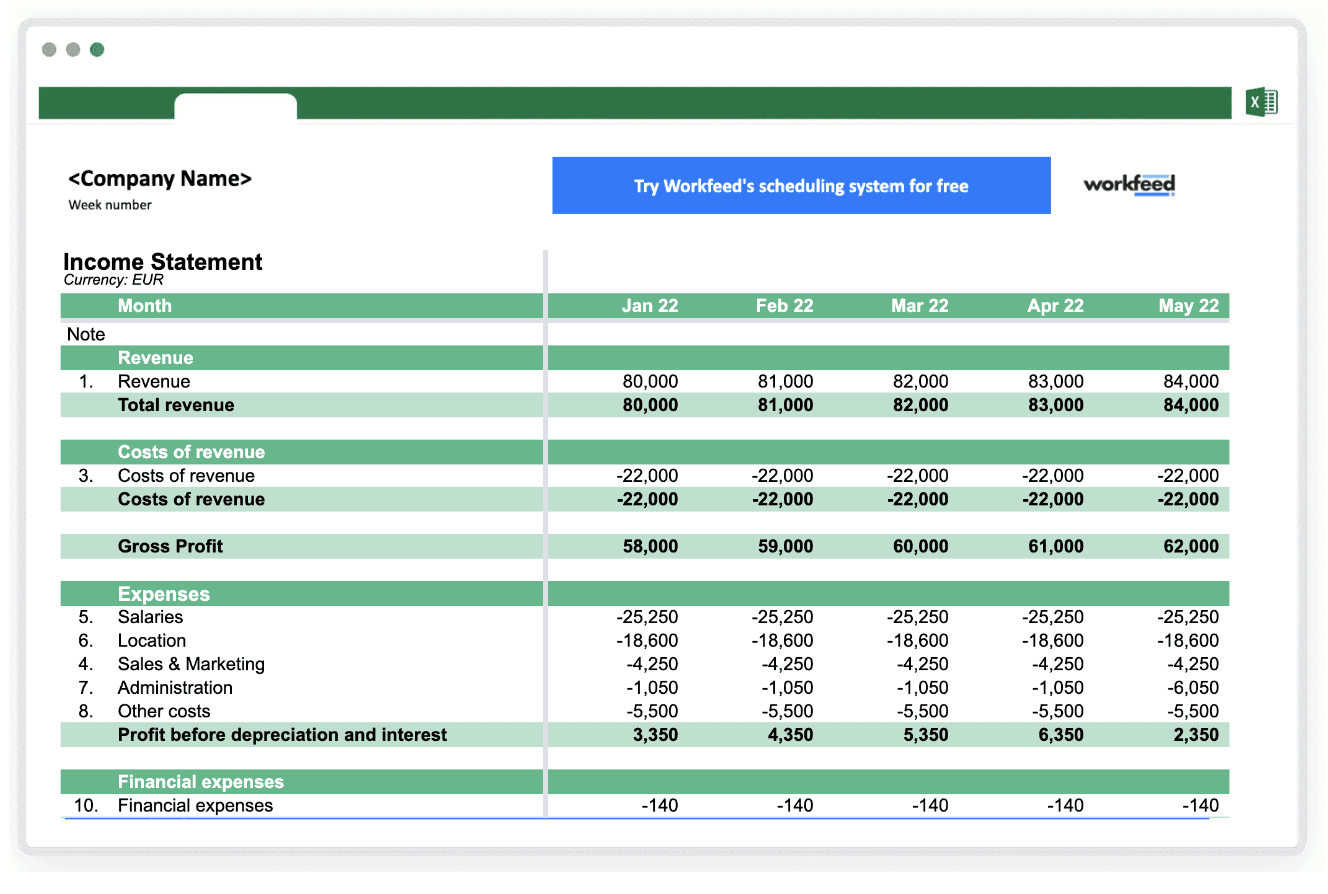

Workfeed is a great platform helping businesses with employee scheduling, time tracking, leave management, and features like a time clock, employee app, and integrations. It provides a business budget template with a user-friendly interface and customizable features. The template allows real-time updates and seamless team collaboration, ensuring everyone on the team is on the same page.

This template has three main sheets: an income statement, a balance sheet, and a cash flow statement. These three sheets collectively offer a comprehensive view of the company’s financial performance, stability, and cash management.

To download the template, you need to fill out a short form entering your basic details like name and email. You will get your template by email, ready to download and customize as per your business needs.

Final Words

Making your business budget and managing your finances can seem a daunting task. Templates enable you to effectively plan and monitor your finances with its structured framework for organizing financial information. You can easily input your projected income and expenses, set financial goals, and track your progress over time.

Regularly updating and reviewing the information in the templates gives you better visibility into your financial health and make informed decisions regarding resource allocation, cost management, and revenue generation.

Utilizing business budgeting and financial management templates offers several advantages. It is a valuable resource for entrepreneurs and business owners, enabling them to maintain accurate financial records, gain insights into their financial standing, and make well-informed financial decisions, all while minimizing the risk of errors and saving valuable time.

By leveraging templates, you can enhance your financial management practices and make more informed decisions for the success of your business.